When you apply for a personal loan, your credit score is one of the most important factors lenders consider. The better your debt management, the more likely you will receive approval for a loan application. But what is a credit score, and how can you improve yours?

This article will explain everything you need to know about credit scores for personal loans. We’ll also give you some tips on how to improve your credit score.

What's A Credit Score?

A credit score predicts how likely you will pay back a loan on time. A credit score comes from the information on your credit report. Your credit score determines your ability to get approved for a personal loan.

Your credit score is calculated based on your credit history. It shows lenders how experienced you are with managing your finances. Generally, lenders are less likely to lend money to you if you have a low credit score. Most lenders offer their most competitive loan offers with the best terms to borrowers with high credit scores.

Borrowers with good credit scores are considered less likely to default. Therefore, a good credit score is crucial to securing an excellent interest rate for any personal loan.

What Makes Up Your Credit Score?

Your credit score is a significant number that reflects your overall financial health and behavior. This number is based on information found on your credit report, which the three credit bureaus maintain: Experian, TransUnion, and Equifax.

Each of these credit bureaus has a different version of your score. Scores are calculated using FICO® Score or VantageScore®. These scores use math to predict whether you can repay debts on time and in full each month.

Most lenders use FICO® credit scores to evaluate a borrower’s creditworthiness. Also available is the AdvantageScore® report that gives consumers detailed information about their credit score to improve it. Despite not being the same as FICO®, it offers practical steps to better credit.

Looking for a Personal Loan?

Explore your options today!

The Five Categories Of Your Credit Score

Your credit score is based on the following five factors:

Payment History (35%)

Payment history is the most important factor in your credit score, accounting for 35% of your total score. A single late monthly payment can significantly impact your score, and a history of late payments will drag your score down even further.

Additionally, negative marks like charge-offs, collections, and bankruptcies can stay on your report for 7 to 10 years, making it difficult to improve your credit score. Therefore, it is essential to make all of your payments on time and avoid any potential negative marks on your credit history.

Amounts Owed (30%)

The second most important factor in your credit score is the amount of debt you owe. You have direct control over this, and it’s important to use your credit wisely to maintain a good score. You don’t want to max out your credit cards or other lines of credit, as this can look like you’re overextending yourself.

Maintaining your credit utilization rate can go a long way in keeping a good credit score. It’s good to keep your overall utilization rate below thirty percent. By following this rule, you can ensure that your debt levels are manageable and that you’re using your credit responsibly.

Length Of Credit History (15%)

A long credit history that includes both installment and revolving loans will give lenders a more comprehensive view of your financial track record. By doing this, lenders will see that you are reliable when paying back what you owe.

Credit Mix (10%)

To maintain a good credit score, you need to have a variety of credit types. Your credit mix makes up about ten percent of your overall credit score, and having the right blend is crucial in establishing a solid financial history.

Lenders consider your credit mix when determining your eligibility for a loan or credit card. A healthy credit mix indicates your financial stability and capability of managing your finances.

With smart borrowing habits and regular maintenance of your various accounts, you can maintain a healthy score for years to come.

New Credit (10%)

New Credit accounts for ten percent of your credit score. It measures the number of inquiries, or credit checks, that appear on your credit report.

When you apply for a personal loan and a lender checks your credit report, this is known as a hard inquiry. Hard inquiries appear on your credit report for 24 months. Some hard inquiries may lower your credit score for up to 12 months.

Soft inquiries may show up on your credit report, but only if you check your credit score yourself. A soft inquiry usually happens when you check your own credit or a lender targets you for a pre-approved offer. Soft inquiries never impact your credit score.

It’s a good idea to only apply for a personal loan or credit card when you need it. But don’t be afraid to take advantage of an appealing offer if you have a good credit rating.

How Your Credit Score Affects Your Chance Of Getting A Personal Loan

Now that you know the basics of credit scores and how they are calculated, let’s look at how your credit score affects your chances of getting a personal loan.

Higher credit scores will provide you with better rates and terms and better approval chances.

Your credit score and debt-to-income ratio (DTI) are two factors lenders consider when evaluating your eligibility for a personal loan.

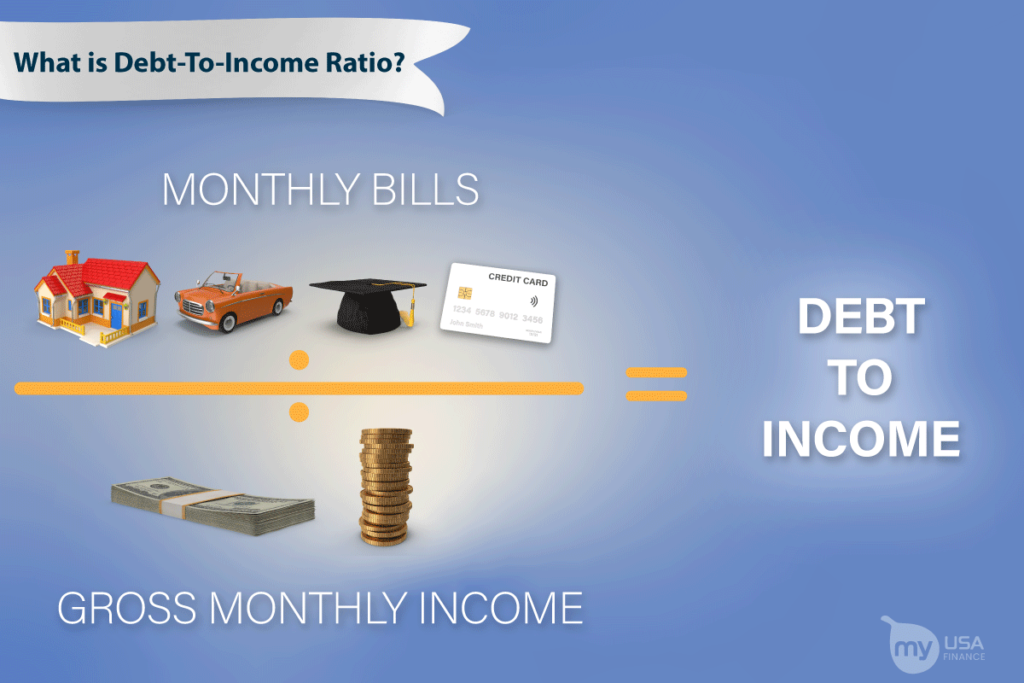

Understanding Debt-To-Income Ratio

Lenders will often look at your debt-to-income (DTI) ratio when considering you for a personal loan. Your DTI ratio is a representation of the percentage of your monthly gross income that goes towards debt each month.

For example, if your DTI ratio is 15%, that means 15% of your monthly income is dedicated to debt payment each month. A low DTI ratio is usually preferable to lenders because it indicates that you have a good balance between your debt and income.

On the other hand, a high DTI ratio might make lenders hesitant to give you a loan because it could signal that you have too much debt relative to your income.

Keep in mind that your DTI ratio is just one factor that lenders will consider when making their decision – so even if you have a high DTI, you may still be eligible for a personal loan.

How to calculate your debt-to-income ratio

Your debt-to income ratio (DTI) is the percentage of your gross monthly income that you use to pay off what you owe each month. To calculate your DTI, add together your monthly debts, then divide them by your total gross income.Your gross income is your income before taxes and other deductions.

Step 1: Add up your monthly bills which may include:

- Monthly rent or mortgage payment

- Minimum credit card monthly payments

- Monthly loan payments – auto-repair loan, student loan, personal loan, etc

- Other monthly debts

Step 2: Divide by monthy income

Divide the total by your gross monthly income, which is your income before taxes.

Step 3: Multiple results by 100

The result will be a decimal, multiply the decimal number by 100 to get your DTI percentage.

What Credit Score Is Needed For A Personal Loan?

As you have learned throughout this article, your credit score is an important indicator of your ability to manage debt and repay financial obligations. Because it reflects how likely you are to repay debt, it is the primary factor lenders consider when evaluating your eligibility for a loan.

Generally, a credit score requirement of 550 – 600 qualifies you for a personal loan, although this can vary depending on the lender you work with. If your credit score falls in this range, you can expect a high-interest rate on your loan and may have only limited options available to you.

However, if you take steps to improve your credit over time and demonstrate steady repayment behavior, you can work toward raising your credit score and increasing your chances of qualifying for better loans with more favorable terms in the future.

Read more: 5 Things You Need to Know Before Taking Out a Personal Loan

Find the Best Personal Loan for You

Get prequalified loan offers in 2 minutes or less – with no impact to your credit score

Loan Amount

$1,000 - $40,000

Min FICO Score

660

Loan Amount

$1,000 - $35,000

Min FICO Score

300

Ready to Apply?

Are you ready to take the next step towards achieving your financial goals? A personal loan can be a great way to help finance everything from paying for auto-repairs to consolidating your debt.

But it’s important to understand exactly what you’re getting into before applying for a loan or credit card. With our simple, streamlined application process, you’ll be able to find out in no time whether or not you qualify for funds. Whether your money goals are big or small, trust us to help you achieve them. Get started today and start reaching your financial goals!