What is a FICO score? How is it different from a credit score? Do you have to pay to get your FICO score? We’ll answer all of these questions and more in this article.

Keep reading to learn more about this important financial metric.

What is a FICO score?

FICO scores are a type of credit score. The name is derived from the Fair Isaac Corporation, which developed the FICO score in 1989. While the words “credit score” and “FICO score” are sometimes used interchangeably, other brands of scores exist.

What is the FICO score range?

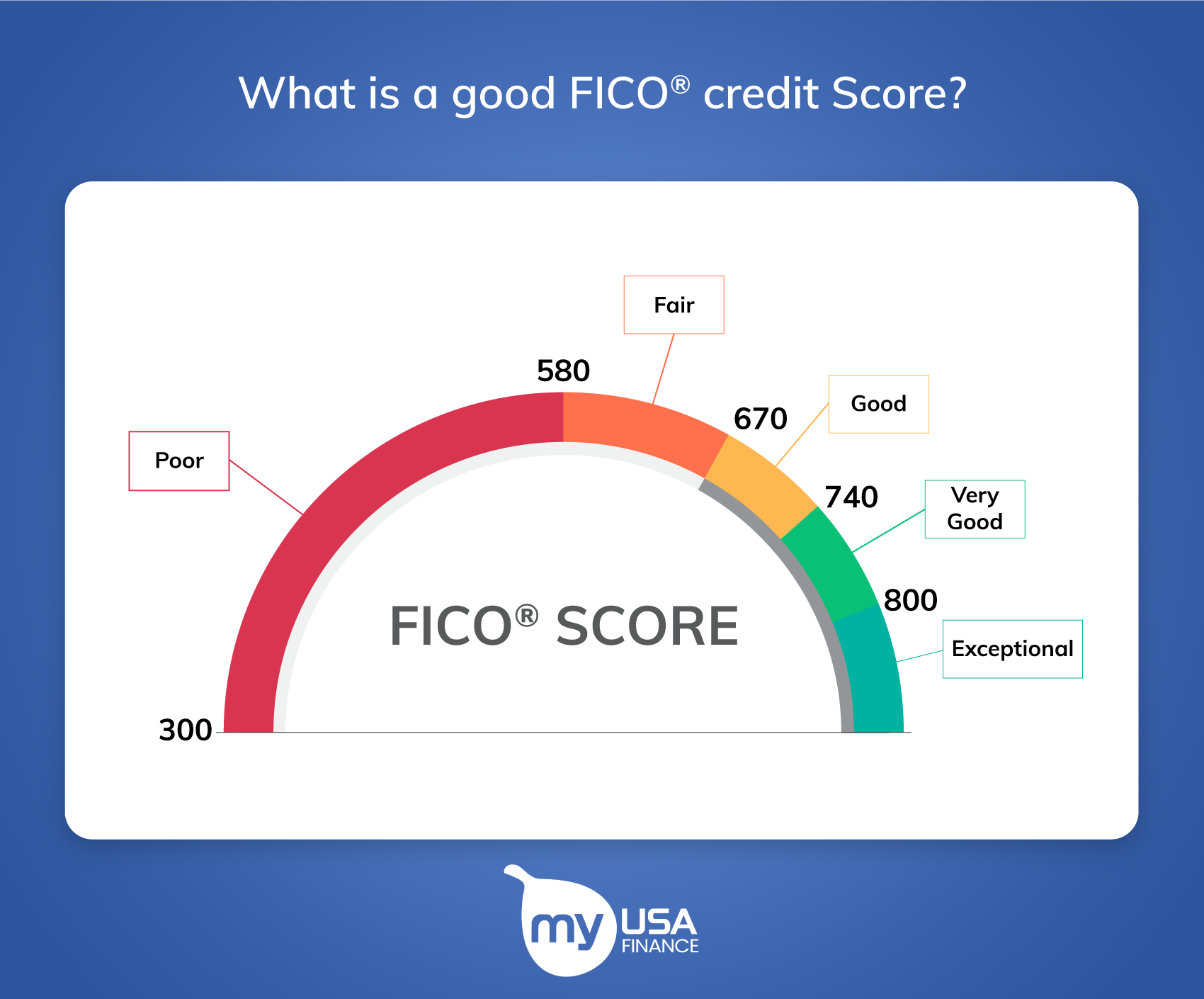

The majority of scores fall within a range of 300 to 850, and a higher score indicates better credit. Credit cards and automobile loans have their own industry-specific ranges, which start at 250 and go up to 900.

How is a FICO score calculated?

The company applies a proprietary formula to the data in your credit reports to produce a score.

Often, the three credit bureaus that create your credit reports — Equifax, Experian, and TransUnion — have slightly different data from one another. So your score may vary depending on which bureau’s data was used.

What affects your FICO score?

FICO doesn’t reveal its scoring formula, but it does provide helpful hints about what affects your credit scores. As you can see, paying on time and maintaining low balances account for roughly two-thirds of your score:

1. Payment history (35% of your score)

Late payments can have a significant negative impact on your credit score, and so-called “back accounts” or bankruptcies are no exception.

2. Ratio of debt to credit limits in percent (30%)

When calculating your credit score, the company looks at how much of your available credit you’re utilizing. The less, the better for your score.

3. Age of credit (15%)

You calculate this number by dividing your total credit lines by the average age of your accounts.

4. Recent credit applications (10%)

When you apply for new credit, a “hard inquiry” might temporarily lower your score by up to six months. That’s why it’s critical to understand the terms and requirements for credit cards before making an application.

5. Types of credit (10%)

Mixed credit history can help you improve your credit score – which includes both installment loans (which require regular payments like a mortgage or auto loan), and revolving loans (such as credit cards).

FICO score vs. credit score

FICO scores are one type of credit score (VantageScore is another), but FICO scores are available in different forms. Among the most commonly used FICO scores, FICO 8 is most commonly used, followed by FICO 9. The FICO scores used by mortgage lenders are typically much older. Newer versions of the FICO include FICO 10 and FICO 10T.

Another newer type is UltraFICO, which is best suited for people who are new to credit or trying to rebuild it. The score is based on the same 300-850 range, but it uses the activity in deposit accounts.

Tips for improving your credit score

There are steps you can take to boost your FICO Score or credit score:

- Always pay on time. Your payment history accounts for 35% of your FICO score, making it the most important factor in building good credit.

- Limit your revolving debt. FICO scores are calculated based on “utilization,” which is 30% of your credit limit. Keeping your balances well below 30% is a good idea according to financial experts.

- Avoid applying for credit frequently. While this will not affect your credit as much as your payment history and utilization, it’s still wise to apply for new credit only sparingly. When you open up a new card, you reduce the age of your average accounts – so the older your accounts are, the better you do for your score. Additionally, credit card applications will typically result in a hard inquiry, which will negatively impact your credit score.