‘Tis the season to be jolly, but it’s also the season to be careful with your spending. The holidays can be a significant source of stress for many people, and one of the biggest causes is holiday debt.

If you’re worried about racking up debts this season, never fear! With some planning and dedication, you can avoid holiday debt entirely.

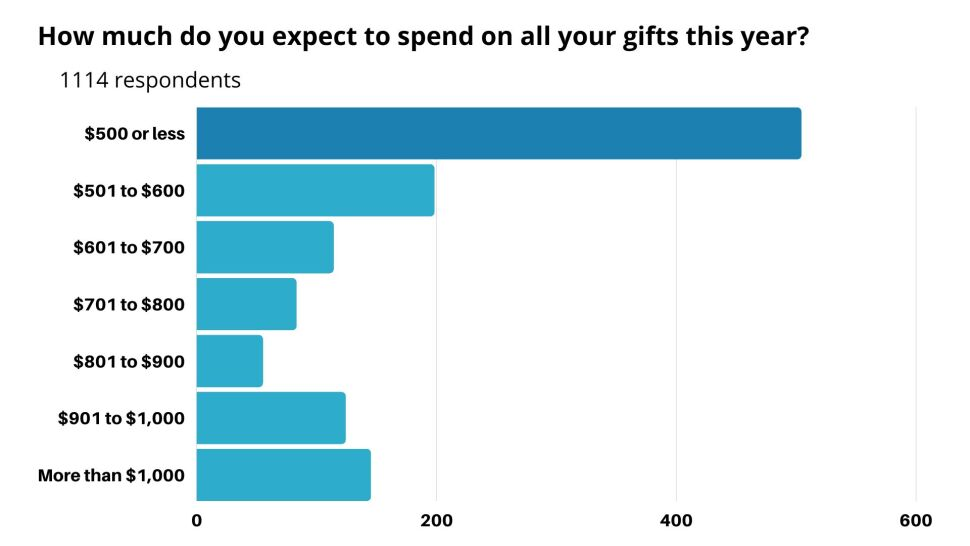

How Much Are Americans Spending This Holiday?

A little over 41% of shoppers plan on spending $500 or less on shopping this year. In contrast, nearly 12% are planning to spend $1,000 or more on shopping.

5 Ways to Avoid Holiday Debt

1. Plan and budget

Start your holiday shopping with a plan to avoid holiday debt. Make sure you create a budget, holiday gift list, and grocery list if you’re hosting any parties.

2. Shop Around For Deal And Coupons

One of the most effective ways to save at any store is to shop for deals, particularly during the holidays. Since many promo codes and coupons are available online today, waiting until something is on sale is a good idea.

There are many helpful tools to make shopping easier, such as shopping apps and browser extensions allowing you to track price trends, compare prices at different merchants, find coupon codes, and even earn cash back.

Tools like Honey can help you find special offers and apply them effortlessly — some users have even reported saving hundreds of dollars by using this intuitive plugin! You can make the most of your budget every time you shop by taking advantage of sales opportunities.

3. Avoid buy-now, pay-later apps

Buy-now, pay-later apps may be appealing for holiday shopping this season, but making purchases through one of these services can create financial hardship in the future.

The interest rates and late fees associated with BNPL transactions make them less attractive than they appear at first glance. Before using a buy-now-pay-later app, you should be aware of potential pitfalls.

In addition, missed payments can negatively impact your credit score immediately. According to a recent survey by Credit Karma, 72% of people who missed payments had their credit scores lowered.

Read More: What is a Holiday Loan and How Does It Work?

4. Make Your Holiday Gift List Shorter

One of the best ways to stay within budget during the holiday season is to take a step back and evaluate who deserves what kind of gift on your list. If someone is not that close, why buy them something expensive?

Instead, you could use your baking talents or craftiness to create something special for them, saving yourself some money and showing that person how much you care.

Giving homemade cookies or a DIY project does not show a lack of thought – it shows resourcefulness and creativity, which can help spread holiday cheer without busting your budget.

5. Take advantage of your credit card rewards

Get some much-needed financial relief by using credit card rewards. Use the cash back, points, and travel rewards earned throughout the year to pay for your holiday expenses.

This is an easy way to save money as you shop for gifts and plan for holiday celebrations without worrying about exhausting your budget until New Year’s Day!

Looking for a Personal Loan?

Explore your options today!

This holiday season, make a plan to avoid holiday debt by budgeting for your purchases, shopping around for deals, and using credit card rewards.

Make your holiday gift list shorter this year and focus on giving personalized gifts. By following these tips, you can enjoy the holidays without financial stress.