The tools, knowledge & options to reach your financial goals

Take the steps your future self will thank you for...

-

Personal Loans

-

Credit Cards

-

Credit Score

-

Debt Relief

Request up to $50,000 in just a few clicks

Our convenient loan process allows you to submit one loan request to hundreds of lenders, giving you a better chance of finding the loan that's right for you. Once you're matched with one of our trusted partners, accept their lending terms and receive funds as soon as the next business day!

Request A Loan

Shop and compare the best credit card options

Find the perfect credit card for your lifestyle. Compare rewards, cash back, travel benefits, and more. Our marketplace connects you with top credit card issuers offering exclusive deals and competitive rates.

Shop Credit Cards

Compare options for tracking and monitoring your credit score

Stay on top of your financial health with credit monitoring tools. Get alerts for changes, track your progress, and receive personalized tips to improve your score. Knowledge is power when it comes to your credit.

View Credit Score

Find the best option for lowering your debt

Take control of your debt with personalized solutions. Whether it's consolidation, settlement, or management programs, we'll help you find the right path to financial freedom and peace of mind.

View Options

The right tools to help build, maintain & grow your finances

Taking control of your finances doesn't have to be an overwhelming task. My USA Finance gives you access to the industry's most powerful tools to get back on track financially. You can view your credit score, apply for credit cards and loans, or consolidate your debts into manageable monthly payments.

Build

Start your financial journey with a starter credit card or monitor your credit score.

Maintain

Stay up to date with payments or pay down debt with a personal loan.

Grow

Find credit cards with the best benefits, utilize credit lines and take advantage of your financial health.

Financial tools you need, at your fingertips

The road to financial progress can be an unpredictable one. Unexpected and emergency expenses can lead to missed or late payments on bills, damaging your credit score and setting you further and further back. My USA Finance partners with lenders and can help find you loans to cover expenses until you are back on track without scuffing your credit rating!

Learn MoreQuick access to financial products

Shop & Compare Everything

Find the perfect solution to elevate your finances by comparing products like credit cards, loans, and more side-by-side in our diverse financial marketplace.

Apply In Minutes

Submit an application directly with our partners or submit a loan request through our secure online form, and we'll connect you with lenders in minutes.

Get Relief

Our secure digital process allows you to get a decision, review, and sign terms electronically in minutes. Giving you fast financial relief without missing a step.

It's never been easier

MyUSAFinance makes getting financial help when you need it easier than ever. We partner with trusted lenders so you have the best chance of finding a loan regardless of your credit score.

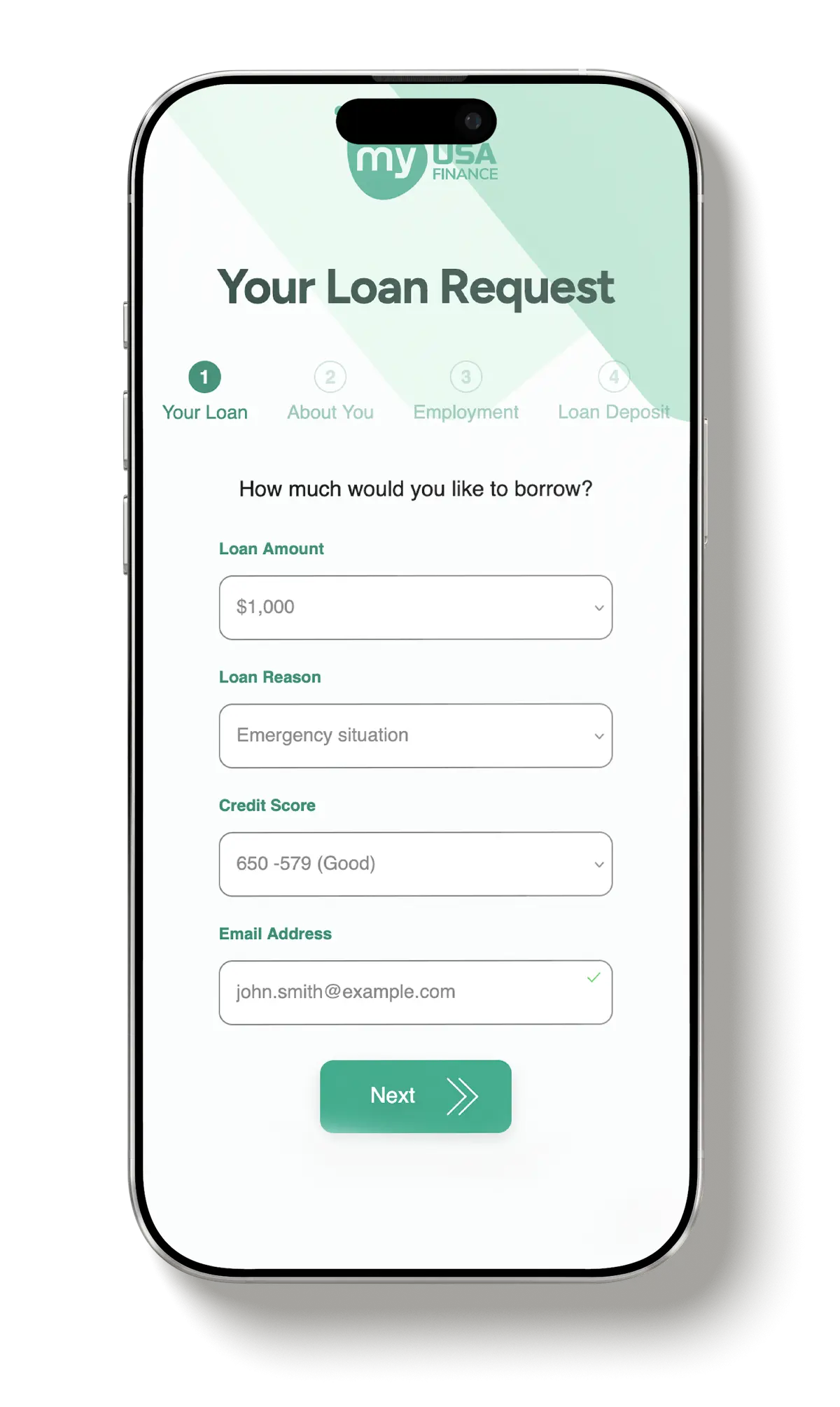

Submit a loan request

Fill out our safe and secure online form in minutes. Simply let us know how much you need, a little bit of information about yourself, and where you want your funds deposited.

Receive a response in minutes

Submit an application directly with our partners or submit a loan request through our secure online form, and we'll connect you with lenders in minutes.

Get support in minutes

Our secure digital process allows you to get a decision, review, and sign terms electronically in minutes. Giving you fast financial relief without missing a step.

Ready to build your financial future?

Shop, compare and apply for the financial products you need to make your future self successful, fulfilled and stress free.